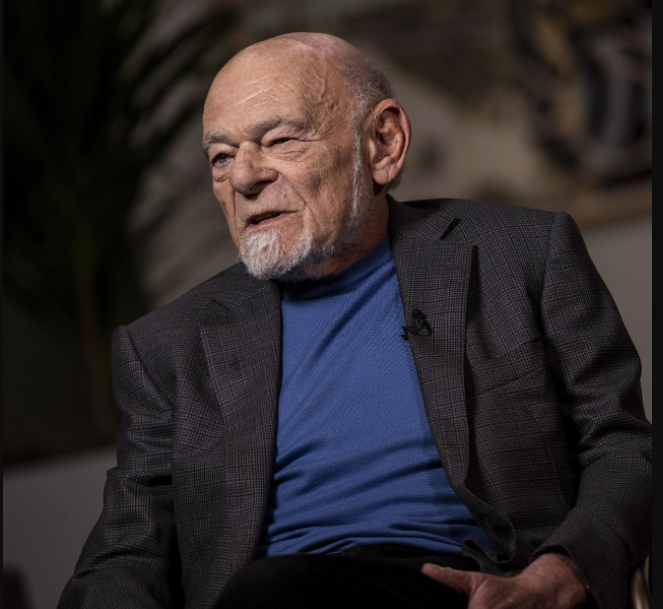

Sam Zell death ? Sam Zell is one of the most successful and influential real estate investors in the world. He is the founder and chairman of Equity Group Investments, a private investment firm that has interests in various sectors, including energy, healthcare, transportation, media, and hospitality. He is also the chairman of Equity Residential, Equity Lifestyle Properties, Equity Commonwealth, and Covanta Holding Corporation, among other public companies. He has a net worth of $5.5 billion as of May 2021, according to Forbes.

But recently, there have been rumors circulating online that Sam Zell has death. Some sources claim that he passed away on May 23, 2023, after suffering a heart attack at his home in Chicago. Others say that he was killed in a plane crash while traveling to a business meeting in New York. Some even suggest that he was assassinated by his enemies or rivals in the industry.

So what is the truth behind these rumors? Is Sam Zell really dead or alive? And what are the implications of his death or survival for his businesses and the real estate market?

The Origin of the Rumors Sam Zell death

The rumors about Sam Zell’s death seem to have originated from a fake news website called www.breakingnews247.net. This website allows anyone to create and share prank news stories with their friends or social media followers. The website clearly states that it is a humoristic platform and that its content is not true.

However, some people may not notice this disclaimer or may take the stories seriously without verifying their sources. This is how the rumor about Sam Zell’s death spread like wildfire on the internet. The fake news article claimed that Sam Zell died of a heart attack at his home in Chicago on May 23, 2023, at around 10:30 am. It also quoted a fake statement from his family confirming his death and expressing their grief.

The article was shared by thousands of people on Facebook, Twitter, Instagram, and other social media platforms. Many people expressed their shock and condolences for Sam Zell and his family. Some also speculated about the impact of his death on his businesses and the real estate market.

The Response from Sam Zell and His Companies

As soon as the rumor about Sam Zell’s death reached his attention, he issued a statement to deny it and assure his fans and investors that he is alive and well. He also condemned the fake news website for spreading such false and malicious information about him. He said that he is considering taking legal action against the website and anyone who shared or promoted the rumor.

He also posted a video on his official Twitter account showing him at his office in Chicago, working on his latest deals and projects. He said that he is grateful for all the support and concern he received from his friends and colleagues in the industry. He also joked that he is not planning to die anytime soon and that he still has a lot of work to do.

His companies also released statements confirming that Sam Zell is alive and healthy and that their operations are running smoothly as usual. They also warned their customers and partners not to believe any rumors or misinformation about Sam Zell or his businesses. They said that they will continue to follow Sam Zell’s vision and leadership in creating value and innovation in the real estate sector.

Tom Holland Net Worth 2023: How Much Does the Spider-Man Star Earn?

The Impact of Sam Zell’s Death or Survival on His Businesses and the Real Estate Market

Sam Zell is widely regarded as one of the most visionary and influential real estate investors in history. He has been nicknamed “the Grave Dancer” for his ability to buy distressed properties at bargain prices and turn them around for huge profits. He has also been called “the King of REITs” for his role in creating and expanding the real estate investment trust (REIT) industry in the US.

He has invested in various types of properties, including office buildings, apartments, hotels, shopping malls, mobile home parks, warehouses, power plants, newspapers, radio stations, and more. He has also invested in different markets around the world, including Brazil, China, India, Mexico, Poland, Romania, Russia, South Africa, and more.

He has been praised for his entrepreneurial spirit, his contrarian approach, his risk-taking attitude, his creativity, his foresight, and his philanthropy. He has also been criticized for his aggressive tactics, his controversial opinions, his political influence, and his environmental impact.

If Sam Zell were to die suddenly, it would be a huge loss for his businesses and the real estate market. He would leave behind a vast empire of assets and liabilities that would need to be managed and distributed by his heirs and successors. His death could also trigger a wave of uncertainty and volatility in the market, as investors and competitors would try to assess the implications of his absence and adjust their strategies accordingly.

However, if Sam Zell were to survive and continue to lead his businesses and the real estate market, he would likely maintain his reputation and influence as one of the most successful and innovative real estate investors ever. He would also likely pursue new opportunities and challenges in the industry, as he has always done. He would also likely continue to share his insights and wisdom with the next generation of entrepreneurs and leaders.

Endorsements and Philanthropy

Bearded and blunt-spoken, Zell reveled in bucking traditional wisdom. He had a golden touch with real estate, and got his start managing apartment buildings as a college student. By the timehe reached his 70s, he

had amassed a fortune estimated at $3.8 billion.

Zell sold Equity Office, the office-tower company he spent three decades building, to Blackstone Group for

$39 billion in 2007. It was the largest private equity transaction in history, and Zell personally netted $1 billion.

A month later, he made another deal that ultimately tarnished his image: the acquisition of the ailing Tribune Co. for $13 billion. The media giant filed for bankruptcy the following year. Real estate was his trademark, but as he noted in an interview shortly before making the ill-fated Tribune deal, it represented only about 25% of his holdings. “I’m a professional opportunist,” Zell told The Associated Press at the time. “I’m pretty sure that no matter what topic you pick, we’re involved in some way or another.”

A Self-Made Man

Zell was born in Highland Park, Ill., on Sept. 28, 1941, four months after his immigrant parents arrived in the United States. They fled Poland before the Nazi invasion. His father was a wholesale jeweler who dabbled successfully in real estate investment and the stock market.

The young Zell took pictures at his 8th-grade prom and sold them, and later took to buying Playboy magazines

in downtown Chicago and reselling them to his classmates in Hebrew school in the suburbs for a 200% markup.

His first successes in real estate came while he was a student at the University of Michigan. After managing the building where he lived in exchange for free rent, he moved on to managing other properties, ultimately incorporating an apartment-management business and then selling it.

After working briefly at a Chicago law firm, he teamed with his Ann Arbor fraternity brother Robert Lurie and they began acquiring distressed properties from developers who were bogged down by high interest rates. That practice continued through the recession of the mid-1970s, with great success.

He later co-founded the Samuel Zell & Robert H. Lurie Institute for Entrepreneurial Studies at the University of Michigan’s Ross School of Business in 1999 with Lurie’s widow, Ann.

Kim Kardashian Net Worth :How Much Does the Reality Star and Entrepreneur Make?

A Grave Dancer

Zell earned his nickname “the grave dancer” for his knack of buying troubled properties at bargain prices and turning them around for huge profits. He once described his strategy as “buying when there’s blood on the street.”

He applied this approach to various sectors, including energy, transportation, health care and communications. He also invested in emerging markets such as Brazil and India.

One of his most notable deals was buying Rockefeller Center in New York City for $1.85 billion in 1996 with a group of investors. He sold it four years later for $2.2 billion. He also owned stakes in several public companies, such as Equity Residential (EQR), Equity LifeStyle Properties (ELS), Equity Commonwealth (EQC) and Anixter International (AXE).

A Controversial Figure

Zell was not without controversy. He faced criticism for his management style and business decisions at Tribune Co., which owned newspapers such as The Chicago Tribune and The Los Angeles Times as well as TV stations and the Chicago Cubs baseball team.

He took over the company with an $8 billion debt load and a complex employee stock ownership plan that later became the subject of lawsuits. He clashed with journalists over editorial independence and cost-cutting measures. He also made headlines for using profanity and making inappropriate remarks in public forums.

He eventually stepped down as chairman and CEO of Tribune Co. after it emerged from bankruptcy protection in 2012.

Zell was also known for his outspoken views on politics and economics. He supported Republican candidates and causes and opposed higher taxes and regulations. He once called President Barack Obama “the most anti-business president” in US history.

He also predicted several market crashes and bubbles before they happened, such as the dot-com bust in 2000 and the housing collapse in 2008.

A Philanthropist

Zell was generous with his wealth and supported various charitable causes. He donated millions of dollars to educational institutions such as the University of Michigan, Northwestern University, Harvard Business School and Stanford University.

He also funded scholarships for low-income students, research programs for entrepreneurship and innovation, cultural initiatives such as museums and theaters, and Jewish organizations such as Birthright Israel and The American Jewish Joint Distribution Committee. He is survived by his wife Helen Zell; their two daughters; their son-in-law; four grandchildren; two sisters; one brother-in-law; nieces; nephews; grandnieces; grandnephews; cousins; friends; colleagues; partners; employees; investors; mentees; admirers; fans; critics; rivals; enemies; frenemies; haters; lovers; followers; leaders; dreamers; doers; makers; shakers; movers; groovers; winners; losers; believers; skeptics; optimists; pessimists; realists; idealists; capitalists; socialists; anarchists; monarchists; democrats; republicans; independents; libertarians; conservatives; liberals; moderates; radicals; centrists; leftists; rightists; centrists; extremists; moderates; progressives; reactionaries; revolutionaries; reformers; traditionalists; innovators; imitators; creators; destroyers; builders; breakers; thinkers; doers; talkers; listeners; writers; readers; watchers; actors; singers; dancers; players; coaches; teachers; students; mentors; mentees; friends; foes; and everyone else who knew him or knew of him.

He will be remembered as one of the most influential figures in American business history.

Nick Cannon’s Net Worth 2023: TV and Music Career Earnings

Conclusion

Sam Zell is alive and well, despite the rumors that claim otherwise. He is still working hard on his businesses and projects, and he is still making an impact on the real estate market. He is one of the most respected and admired real estate investors in history, and he has a lot to teach us about value creation, innovation, and leadership.